Note4Students

From UPSC perspective, the following things are important:

Prelims level: Not much

Mains level: Mains level : Economic recovery amid coronavirus pandemic

- India’s GDP for the period April to June 2020 has contracted by 23.9 percent.

- In other words, the total value of goods and services produced in India in April, May and June this year is 24% less than the total value of goods and services produced in India in the same three months last year.

- What is worse is that, because of the widespread lockdowns, the data quality is sub-optimal and most observers expect this number to worsen when it is revised in due course.

India’s GDP numbers

Almost all the major indicators of growth in the economy — be it production of cement or consumption of steel — show deep contraction. Even total telephone subscribers saw a contraction in this quarter.

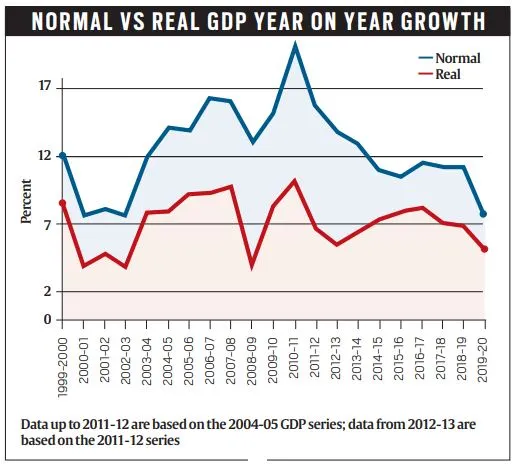

Chart 1: India’s GDP story since economic liberalization. Source: McKinsey and Express Research Group.

Chart 2: Percentage change in key indicators. Source: Ministry of Statistics and Programme Implementation

What contributes to India’s GDP?

GDP measures the monetary value of all goods and services produced within the domestic boundaries of a country within a timeframe (generally, a year).

In any economy, the total demand for goods and services — that is the GDP — is generated from one of the four engines of growth.

- The biggest engine is consumption demand from private individuals like us. Let’s call it C, and in the Indian economy, this accounted for 56.4% of all GDP before this quarter.

- The second-biggest engine is the demand generated by private sector businesses. Let’s call it I, and this accounted for 32% of all GDP in India.

- The third engine is the demand for goods and services generated by the government. Let’s call it G, and it accounted for 11% of India’s GDP.

- The last engine is the net demand for GDP after we subtract imports from India’s exports. Let’s call it NX. In India’s case, it is the smallest engine and, since India typically imports more than it exports, its effect is negative on the GDP.

So total GDP = C + I + G + NX

Now, look at Chart 4. It shows what has happened to each of the engines in Q1.

Chart 4: Engines of growth falter. Source: MoSPI and Express Research Group

Reasons for GDP contraction

The biggest engines, which accounted for over 88% of the Indian total GDP saw a massive contraction. They are as follows:

- Private consumption — the biggest engine driving the Indian economy — has fallen by 27%.

- Investments by businesses: The second biggest engine — investments by businesses — has fallen even harder — it is half of what it was last year same quarter.

- Net export demand: The NX has turned positive in this Q1 because India’s imports have crashed more than its exports. While on paper, this provides a boost to overall GDP, it also points to an economy where economic activity has plummeted.

- Govt. Expenditure: Data shows that the government’s expenditure went up by 16% but this was nowhere near enough to compensate for the loss of demand (power) in other sectors (engines) of the economy.

Issues with govt. expenditure

- Even before the COVID crisis, government finances were overextended.

- It was not only borrowing but borrowing more than what it should have. As a result, today it doesn’t have as much money.

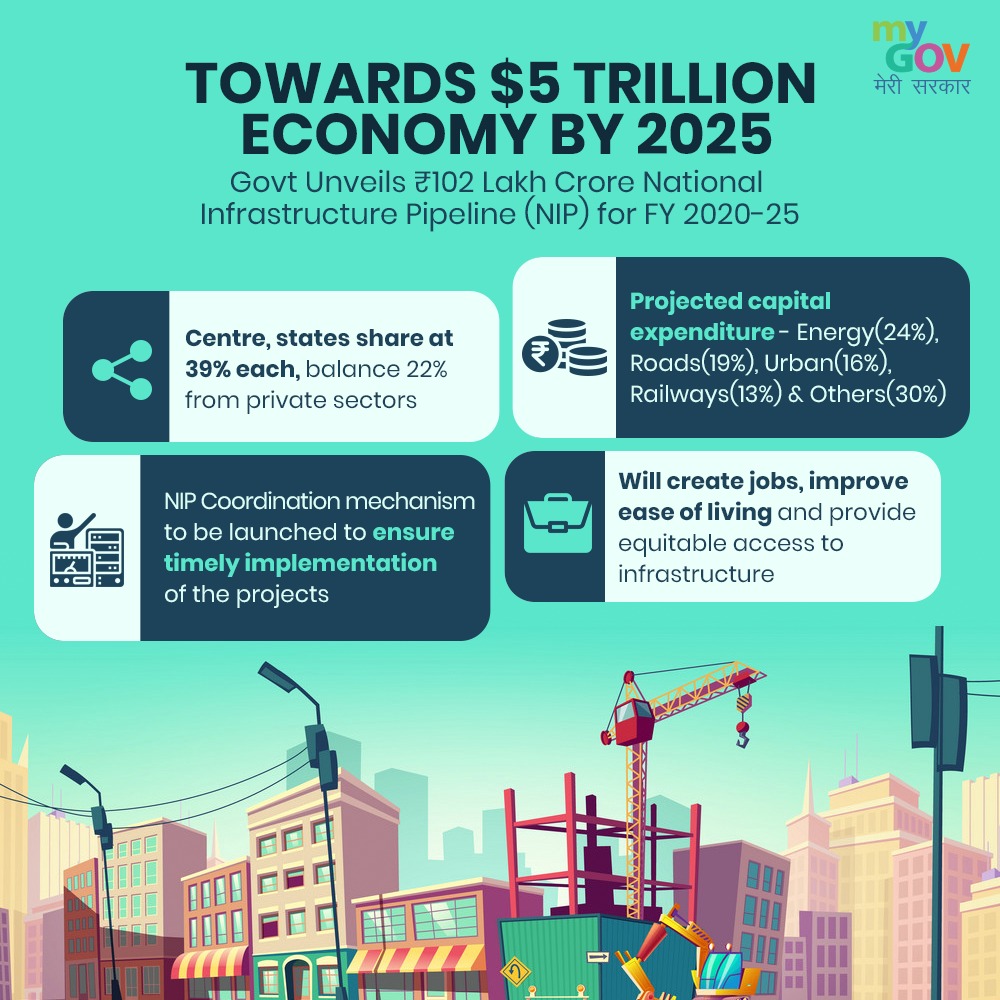

- It will have to think of some innovative solutions to generate resources. Chart 4 by McKinsey Global Institute provides ways in which an additional 3.5 per cent of the GDP can be raised by the government.

Why can’t the government just spend to revive growth?

- First, in all likelihood, temporary incomes coupled with job/income uncertainty will induce precautionary savings without any impact on growth.

- Second, the fiscal situation was weak even before the pandemic. With revenues having cratered, funding of additional expenditure is through higher borrowings.

- Any incremental debt should be seen in the context of future investments being hampered due to current consumption.

Implications of GDP decline

- With GDP contracting by more than what most observers expected, it is now believed that the full-year GDP could also worsen.

- A fairly conservative estimate would be a contraction of 7% for the full financial year.

- Chart 1 puts this in perspective. Since economic liberalisation in the early 1990s, Indian economy has clocked an average of 7% GDP growth each year. This year, it is likely to turn turtle and contract by 7%.

- The worst affected were construction (–50%), trade, hotels and other services (–47%), manufacturing (–39%), and mining (–23%).

- It is important to note that these are the sectors that create the maximum new jobs in the country.

- In a scenario where each of these sectors is contracting so sharply — that is, their output and incomes are falling — it would lead to more and more people either losing jobs (decline in employment) or failing to get one (rise in unemployment).

Impact on Economy

The impact of an economic contraction on an average individual isn’t always in a direct way, like job losses or salary cuts. There are indirect ways as well. Let’s take a look at this pointwise.

- Many companies are encouraging their employees to work from home. This has an impact on those working in the surrounding informal sector leading to a loss of economic activity.

- If people cut down on consumption, it basically means they are spending less than before. This works in various ways. First, businesses, on the whole, see a fall in revenues and a fall in profits. Hence the employees are bound to be impacted.

- Many businesses, in order to stay afloat, have fired employees. Some have cut salaries. Some others have rescinded on the job offers they made.

- Even businesses that are on a strong wicket have given only bare-minimum increments to their employees this year.

- Many big businesses have publicly announced that they are putting all their expansion plans on the backburner currently. If businesses don’t expand, then a fresh set of jobs don’t get created and hence expenditure.

Getting recovered: Way forward

1.Thinking beyond stimulus

To achieve a stipulated economic growth, the government needs to start addressing some of the traditional sore points such as the large infrastructure deficit, the weak financial sector, archaic land and labour laws, and the administrative and judicial hurdles.

- It is easy to prescribe abandoning fiscal prudence or ‘printing money’ to fund spending. But the risk is high compared to the reward.

- This sets the base for any kind of “stimulus” — it should be well-targeted and have a large multiplier effect.

- Instead, they argue, that India needs to broaden its consumer base beyond the top 10- 20 per cent of the population to improve long-term growth prospects.

- This cannot happen with regular doses of consumption stimulus but through creating steady and well-paid employment for the bottom and middle segments.

2.Tax reforms

One area that clearly needs reform is the GST system, which instead of freeing up the Indian economy has acted in a negative way.

3.Improving Public health infrastructure

Another area that clearly needs reform is India’s public health infrastructure.

- While these reforms may not lead to immediate benefits they will work well for the economy in the longer-term, something which we shouldn’t miss out on with the current focus on Covid-19.

- Beyond that, there isn’t much that the government can do. Also, it is worth remembering here that the Indian economy was already in trouble before the pandemic struck.

Raghuram Rajan’s Suggestions

1. Government-provided relief

- The economist pointed out that the government’s reluctance to do more today seems partly because it wants to conserve resources for a possible future stimulus. “This strategy is self-defeating

- Rajan said economic stimulus would work as a tonic and called MNREGA a tried and tested means of providing rural relief which needed to be be replenished as needed.

- Given the length of the pandemic, more direct cash transfers to the poorest households, especially in urban areas that do not have access to MNREGA, is warranted.

2. Expand resources

- India could borrow more without scaring the bond markets if it committed to return to fiscal viability over the medium term – for example, by setting future debt reduction targets through legislation and committing to honest and transparent fiscal numbers with a watchdog independent fiscal council.

- It should prepare public sector firm shares for on-tap sale, to take advantage of every period of market buoyancy.

- Many government and public sector entities have surplus land in prime urban areas, and those too should be readied for sale.

- government would have to set aside resources to recapitalise public sector banks as the extent of losses are recognised.

3. Clear payables quickly, provide rebates to corporations, small firms

- Government and public sector firms must clear their payables quickly so that liquidity moves to corporations.

- Rebates on the corporate income and GST tax depending on firm size would help small viable firms, he said.

4. Plan to deal with financial distress

Government need to plan for financial distress when various entities would be unable to pay as payment moratoria come to an end.

His suggestions to combat this included:

- a variety of structures to help debtors and claimants reach agreements to restructure obligations,

- arbitration forums set up to renegotiate claims of various sizes and beefed up civil courts,

- debt recovery tribunals and the NCLTs to provide rapid back-up judgments.

5. Reforms as stimulus

- Reforms, even if they are not undertaken immediately, could boost current investor sentiment.

- The world will recover earlier than India, so exports can be a way for India to grow,

- His suggestions for this included reversal of recent tariffs increases so inputs could be imported at a low cost and implementation of “long-debated reforms to land acquisition, labor, power” and in agriculture.

References:

https://indianexpress.com/article/explained/gdp-contraction-23-9-the-economics-behind-the-math-6578046/

https://www.deccanherald.com/business/economy-business/gdp-contraction-no-easy-solutions-but-a-chance-for-deep-economic-reforms-883234.html

https://www.newslaundry.com/2020/09/04/explained-how-will-indias-gdp-contraction-impact-you

![Burning Issue] Jobless growth in India - Civilsdaily](https://www.civilsdaily.com/wp-content/uploads/2018/10/word-image-13.png)

Context

Context

Near-term

Near-term

Context

Context What is

What is  What are the Notes of caution?

What are the Notes of caution? Conclusion

Conclusion

Context

Context  How is IIP calculated?

How is IIP calculated? Why is IIP important?

Why is IIP important? Context

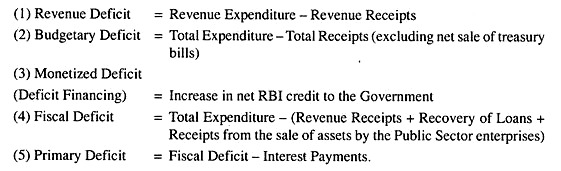

Context  Meaning of fiscal prudence

Meaning of fiscal prudence Why there is a need for Fiscal Council?

Why there is a need for Fiscal Council?